Adding Natural Resources (Tech) to Apeiron’s investment universe - starting with Uranium

Most people know my investment firm, Apeiron Investment Group, for our work and investments in Biotech, Crypto, and Deep Tech. And indeed, those sectors have been our core focus for the past decade. However, the world is changing in profound ways.

Generative AI – especially when paired with robotics – represents a civilizational leap on par with the invention of the semiconductor or even the Industrial Revolution. We’re entering a period of profound transformation — one that calls for a reassessment of which sectors will shape the future and deliver the most meaningful impact - and returns.

Two simple truths have become clear: Human labour as we know it will cease to exist; and none of AI’s promise can be realized without abundant, reliable energy.

Short labour - long energy

I deeply believe that AI & Robotics combined will eliminate the need for human labour. This must not be negative at all. AI will free us up to go back to the lifestyle we had when we were still hunter-gatherers - before we invented agriculture, settled down and started following routines. Back then, we only needed a few hours a day to ‘make a living’, and the rest of the day we socialized with our tribe. We sat around the campfire, told each other stories, gossiped, and entertained ourselves. Humans, freed from a need to work and awarded Universal Basic Income (UBI), will spend their UBI especially on real life consumer goods and experiences.

I also believe AI will kick off an unimaginable economic boom, starting from basic infrastructure needs like data centers (hence our investment into Northern Data) to a general broad industrial boom of “re-industrializing” the West. All those businesses crave for natural resources, especially those needed for energy (like uranium) and for data centers & chips (like silicon, germanium, phosphorus, boron, indium phosphide and copper).

These two beliefs are the reason why we have carefully added “Hospitality, Sports & Entertainment” some years ago and now “Natural Resources (Tech)” to our investment universe – all “hard asset” businesses which will imho prove to be not only much more resilient to AI than for example software and biotech, but to be actually massively boosted by it.

Proudly introducing a new Apeiron division

You already know many of our investments in the “Hospitality, Sports & Entertainment” division, like Enhanced Games, Limestone with its hotels brands AETHOS and Voaara, and DEAG Deutsche Entertainment.

Today, I am very excited to announce that we are starting a new division - “Natural Resources (Tech)”

And we are starting with a bang: Uranium Digital has joined the Apeiron investment universe, and I am coming on board as a strategic advisor to the project. Uranium Digital is soon to launch the world’s first institutional-grade 24/7 spot market for trading uranium – bringing speed, efficiency, and transparency to a market that, frankly, has remained bureaucratic and antiquated for too long.

I deeply believe that:

Innovation Runs on Energy: The key to human progress (from biotech breakthroughs to AI supercomputing) is a clean and expansive power supply. Humanity can only perform at its best if it is energized. We received a stark reminder of this when Spain briefly hit 100% renewable power and then suffered a massive grid blackout that plunged 60 million people in Spain and neighboring countries into darkness.1 The lesson? We need scalable energy that doesn’t falter when the sun sets or the wind stops. Nuclear power uniquely fits that bill as a stable 24/7 source.

Energy independence is resilience: In today’s interconnected world, ensuring a stable and secure energy supply is critical for long-term national and economic planning. Recent geopolitical events and supply chain disruptions have underscored the value of energy sources that are both reliable and locally managed. Nuclear energy offers countries a way to reduce exposure to volatile fossil fuel markets while supporting domestic capacity with long-term, carbon-free baseload power. Governments across Europe are reconsidering decades-old nuclear bans in light of energy security needs, and 31 countries (along with major companies) have now pledged to triple global nuclear capacity by 20502 In short, whoever controls their own energy, controls their own destiny.

A New Day for Nuclear

It’s astonishing that in an age of AI supercomputing and instant global markets, uranium — the backbone of our most scalable clean energy source — still trades like it’s the 1970s. That’s why I’m investing in and advising Uranium Digital, to bring structure and transparency to this overlooked market.

Think about it: oil, natural gas, and even obscure metals trade on modern exchanges with instant price discovery, but uranium (the very stuff that powers 10% of the world’s electricity)3 does not. Uranium is NOT traded in meaningful quantities on any commodity exchange4 with modern financial architecture. Even today, the uranium market runs on closed-door OTC and long-term contracts between a handful of producers and utilities. Prices are often set by infrequent broker quotes or private negotiations, and a “spot” uranium trade can take weeks or more to settle under archaic procedures. It’s an antiquated system begging for innovation.

Uranium Digital will finally bring this critical commodity into the 21st century. By creating a liquid, readily tradable market, price discovery will be driven by supply and demand among a broad set of participants, not by opaque negotiations.

Uranium Digital’s goal is nothing short of establishing the first-ever real-time, 24/7 spot price for uranium – a transparent price that any market participant can rely on, along with the data needed to support robust financial infrastructure. In other words, Uranium Digital aims to be the first institutional-grade market for nuclear fuel, a commodity that perplexingly hasn’t enjoyed the easy trading of its dirtier peers like coal or oil.5

Nuclear’s Strategic Role: Innovation, Security, and Independence

Why nuclear, and why now? Simply put, global energy demand is exploding, and nuclear is uniquely positioned to meet this challenge. The International Energy Agency projects a 62% increase in worldwide electricity demand from 2023 to 2040, and nearly double (+95%) by 2050.4 A major driver of this surge is AI and digitalization – data centers alone, which already consume ~1–2% of global electricity, are expected to triple their power draw by 2030.6 Goldman Sachs analysts forecast that power demand from data centers will rise 165% by 2030 (compared to 2023), largely due to energy-intensive AI workloads.6 In the United States, data centers could consume up to 12% of all electricity by 2028, up from 4% in 2023.7 This “AI boom” in electricity use comes on top of electrification in transport and industry, and the need to bring affordable power to the one-third of humanity still in energy poverty.4

Nuclear energy is already a cornerstone of our electric grid, and it’s poised to grow dramatically. Today there are ~440 operational reactors worldwide with dozens more reactors under construction (61 at last count)4, and hundreds are planned as countries recognize they will struggle to meet climate and energy goals without atomic power. Analyses from the OECD and World Nuclear Association suggest a 3X expansion of nuclear power is needed to achieve mid-century climate goals8. This isn’t idle talk: it’s a global renaissance. The United States, China, India, Europe, the Middle East – all are investing in next-generation reactors, extending lifetimes of existing plants, and fast-tracking small modular reactors (SMRs). Even Big Tech is jumping in: companies like Amazon, Google, and Meta have publicly pledged support for nuclear expansion to ensure the reliable power needed for their operations.2 In fact, a cross-industry group of major energy consumers (including those tech giants) signed a 2025 pledge urging the world to triple nuclear capacity, marking the first time businesses outside the nuclear sector have united behind such an expansion.2

Critically, nuclear provides something no other clean energy source can: dispatchable baseload power. It’s available day and night, rain or shine, providing a stable backbone to the grid. France demonstrated this for decades, and now countries like Poland, Britain, and Japan are increasingly looking to nuclear to shore up energy security.

Western utilities are also urgently re-evaluating their fuel supply chains – for example, seeking to reduce reliance on Russian uranium services after the invasion of Ukraine and sanctions on Russia’s state nuclear company.4 Events like the Niger coup (which halted a major uranium mine) and supply bottlenecks in Kazakhstan have added to these worries.4 Put simply, geopolitics have put a premium on nuclear fuel independence. Countries and companies want uranium supply they can trust – and they’re willing to pay a premium for secure, transparent access to it.

The Uranium Market’s Inefficiencies – An Asymmetric Opportunity

Even as demand for uranium is set to surge, the uranium market itself has remained highly inefficient and opaque. Years of underinvestment left the industry without the modern infrastructure and financial instruments that most commodities enjoy. Unlike oil, coal, or natural gas, there is no robust futures market or widely quoted spot exchange for uranium. Instead, the market has been dominated by a few converters and brokers operating an oligopoly. Uranium oxide (U₃O₈) typically trades via long-term contracts that can span 3–15 years, with utilities locking in supply from producers at negotiated prices. These contracts are confidential and often include premiums for security of supply.9 The “spot” market – where buyers and sellers trade more immediately – occurs through a massively inefficient and fractured market.

This archaic setup leads to several problems. First, poor price discovery – when only a few deals set the price, it may not reflect true supply and demand dynamics. In fact, the uranium “price” often lags reality; it stayed artificially low for years, below production costs, until supply shortages became critical. Second, low liquidity – the inability to quickly buy or sell uranium in volume. In other major commodities, financial markets multiply liquidity manyfold (for example, in natural gas, the volume of paper trading ranges from 20-40x the volume of physical.10, 11 Uranium lacks comparable futures or derivatives markets, so utilities and investors have had no easy way to hedge or gain exposure. Third, slow, high-friction transactions – purchasing uranium can literally take weeks to settle, with arduous processes involving lengthy negotiations, third party brokers, and physical paperwork. There are only three approved storage facilities in the West (in the US, Canada, and France), and each has its own procedures and no incentive to streamline access under the old system.

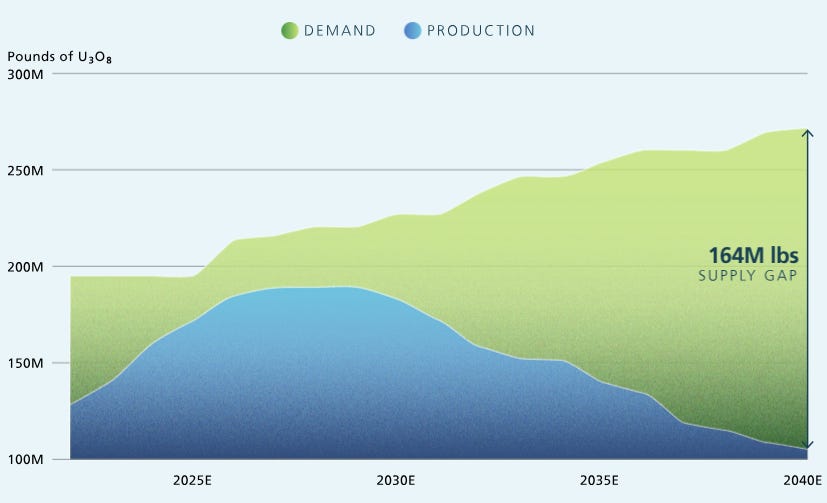

All of this has kept many potential participants out of the market. It’s telling that while global uranium consumption has grown, over 2.1 billion pounds of U₃O₈ required through 2040 remain “uncovered” by long-term contracts4 (approximately USD $150 billion) – utilities need to buy it, but haven’t yet secured it. In fact, the uranium market is currently facing a 30 to 50 million pound annual supply deficit over the next five years — a structural imbalance that continues to support upward pressure on prices.12 This represents a huge opportunity for those who can modernize how uranium is traded.

We believe Uranium Digital is that key. It’s a timely solution arriving at the inflection point of a nuclear revival. Years of status-quo have built up inefficiencies that are now ripe to be arbitraged away. Uranium prices are already climbing amid supply deficits – in 2022-2023, uranium spot prices jumped and prompted restarts of idled mines4 – yet the market still lacks the basic tools for investors to participate. By introducing a transparent, high-throughput trading venue, we unlock the kind of financial innovation that other commodities saw decades ago. Speed matters here: the nuclear renaissance is underway, and trillions of dollars are being mobilized for new reactors and fuel. The uranium market is primed for a leap in liquidity and sophistication. Uranium Digital’s launch comes at the perfect time to catalyze that leap.

Uranium Digital: A 24/7 Marketplace for Critical Infrastructure

Uranium Digital is building a bridge between the traditional nuclear industry and modern digital markets. In essence, the platform tokenizes physical uranium – each digital token represents one pound of U₃O₈ stored in an accredited nuclear facility. Every token is fully backed by one pound of real, verified uranium stored at secure conversion facilities, with proof-of-reserve audits ensuring a strict 1:1 backing at all times. By digitizing uranium in this way, Uranium Digital transforms an illiquid asset into a liquid financial instrument.

For institutional participants — utilities, traders, sovereign wealth funds, and others — Uranium Digital introduces basic infrastructure that has long been missing from the uranium market.

Liquidity: Uranium has historically traded through infrequent and opaque bilateral deals and will now be accessible for continuous trading - 24 hours a day, 7 days a week.

Price transparency: Rather than relying on monthly indices or broker quotes, prices will reflect real-time order flow. This enables a reliable price signal — essential for mine development, procurement planning, and inventory management.

Faster, secure settlement: Transactions that used to take days or weeks can be executed and settled nearly instantly. Each token corresponds to a verified pound of U₃O₈ held in regulated storage, with transparent chain-of-custody and independent proof-of-reserve audits.

Access to financial tools: A digitized format makes it possible to build basic financial instruments around uranium — including spot exposure, forward contracts, and collateralized lending. This brings uranium in line with other commodities that already benefit from developed financial infrastructure.

In short, Uranium Digital introduces the mechanics of modern market structure — continuous access, transparent pricing, transferable ownership, and risk management tools — into a commodity sector that until now has lacked them.

Empowering the Next Human Agenda

At its heart, this initiative is about empowering sovereigns and institutions with the infrastructure to control their energy future. I often talk about the “Next Human Agenda” – the set of ambitious goals and foundational projects that will define humanity’s progress in this century. Ensuring abundant, clean energy is near the top of that agenda. Without sufficient energy, ambitions from AI to space exploration to universal healthcare simply can’t be realized. By modernizing uranium trading, we are helping unlock investment and innovation in nuclear energy when it’s most needed.

Countries will be able to secure fuel supplies more efficiently, strengthening their energy independence. Utilities can optimize fuel procurement and potentially save costs – savings that can be passed to consumers or reinvested in next-gen reactor technology. Investors can confidently back uranium production knowing there’s a liquid market to exit, which in turn can finance new mines and recycling facilities. In short, a transparent uranium market greases the wheels of the entire nuclear energy supply chain. That’s good for business and good for society.

A decade ago, many doubted that nuclear power would play a significant role in the future of energy. Today, that skepticism is gone. Nuclear is recognized as one of the cleanest, safest, and most efficient energy sources we have, and it’s making a comeback.2 To support this comeback, the market for its fuel must also evolve. Apeiron’s investment into Uranium Digital is not just a financial bet; it’s a commitment to the vision of a world where humanity’s access to energy is no longer a limiting factor. It aligns perfectly with our mission to back technologies that enable human flourishing on a global scale.

But this future can only happen if we also upgrade the market mechanisms that underpin the nuclear industry. Uranium Digital is that upgrade. Its launch will, in my view, forever change how humanity interacts with a critical energy resource. By bringing uranium into the digital age, we are taking a decisive step toward an energy-abundant future – one where innovation can truly thrive. I’m thrilled to be part of this journey.

Sources:

Reuters - What caused the power outage in Spain and Portugal - https://www.reuters.com/world/europe/what-could-be-behind-iberian-power-outage-2025-04-29/

Nucnet - Major Energy Users Sign Pledge To Support Goal Of Tripling Nuclear Capacity By 2050 - https://www.nucnet.org/news/major-energy-users-sign-pledge-to-support-goal-of-tripling-nuclear-capacity-by-2050-3-3-2025

IEA - A new era for nuclear energy beckons as projects, policies and investments increase - https://www.iea.org/energy-system/electricity/nuclear-power

Cameco - Supply & Demand - A market in transition - https://www.cameco.com/invest/markets/supply-demand

CoinDesk - Uranium Digital Raises $6.1M to Speed Debut of Crypto-Powered Spot Market - https://www.coindesk.com/business/2025/03/20/uranium-digital-raises-usd6-1m-to-speed-debut-of-crypto-powered-spot-market

Goldman Sachs - AI to drive 165% increase in data center power demand by 2030 - https://www.goldmansachs.com/insights/articles/ai-to-drive-165-increase-in-data-center-power-demand-by-2030

Energy.gov - DOE Releases New Report Evaluating Increase in Electricity Demand from Data Centers - https://www.energy.gov/articles/doe-releases-new-report-evaluating-increase-electricity-demand-data-centers

Energy.gov - At COP28, Countries Launch Declaration to Triple Nuclear Energy Capacity by 2050, Recognizing the Key Role of Nuclear Energy in Reaching Net Zero - https://www.energy.gov/articles/cop28-countries-launch-declaration-triple-nuclear-energy-capacity-2050-recognizing-key

World Nuclear - Uranium Markets - https://world-nuclear.org/information-library/nuclear-fuel-cycle/uranium-resources/uranium-markets

IEA - Gas Market Report - https://iea.blob.core.windows.net/assets/c6ca64dc-240d-4a7c-b327-e1799201b98f/GasMarketReportQ12023.pdf

EIA - Natural Gas Annual - https://www.eia.gov/naturalgas/annual/pdf/nga19.pdf

Uranium Market – Major Breakout In 2024 Happening Now - https://investinghaven.com/markets-stocks/uranium-market-major-breakout-2024/

Sprott - Why Invest in Uranium Miners? - https://sprottetfs.com/uranium-landing-page/