Why Bitcoin can be a valid part of a corporate treasury – especially in the biotech sector

In an era of persistent inflation and volatile markets, I find myself asking an important question for biotech companies looking to preserve and optimize the capital they have: Could allocating a portion of treasury cash to Bitcoin help preserve, optimize, and even extend a company’s runway and hence contribute to its success?

This post outlines my personal thinking on the subject - examining how biotech funding works, why inflation and interest rates disproportionately impact the biotech sector, and whether Bitcoin should play a measured but effective role in strengthening a company’s financial position while it focuses on what truly matters for every biotech company: delivering breakthrough therapies for patients in need.

All of this culminated in the decision taken by atai Life Sciences (Nasdaq: ATAI), the psychedelics-focused biotech company I founded, with respect to its own Bitcoin treasury strategy.

The Nature of Biotech Financing

Drug development is a cash hungry, long-term venture. Pre-revenue biotech companies typically raise large amounts of capital to remain fully financed over the long period of time required to achieve key clinical and regulatory milestones that – in cases where the respective drug proves to be safe and effective - ultimately lead to approval and allow for commercialization. As time has shown, the necessary steps to achieve regulatory approval can easily take more than a decade, starting with preclinical work and encompassing three clinical stage phases, with each phase taking approximately 1-3 years.

This model, whilst essential for advancing drug development, also exposes biotech firms to heightened financial risks in certain macroeconomic environments—particularly during periods of persistent inflation and heightened interest rates:

1. Valuation Pressure: higher interest rates generally increase the discount rate applied in discounted cash flow (DCF) models, often leading to lower biotech valuations, as future earnings, which for biotech companies are often years away, are discounted more steeply.

Illustrating this trend, the XBI biotech index has plunged ~45% from its 2021 peak of ~$160 to just under ~$90 today – concurrent with the Federal Reserve aggressively hiking rates from nearly 0% to 4.5%. However, this figure likely understates the carnage: the XBI rebalanced last year in favor of large caps (e.g., Gilead, AbbVie and Amgen are now the current top holdings), at which time it deviated from being an appropriate representation of small biotech; if adjusted to exclude this rebalancing, the XBI could be closer to ~$45 than ~$90, which would constitute a ~70% decline from its peak.

2. Erosion of Cash Reserves: Unlike revenue-generating companies which can adjust pricing of their products and cash flows to offset inflation, pre-commercial biotechs rely on static cash reserves, which lose purchasing power in inflationary environments.

For example, a 9% inflation rate (CPI, as seen in 2022 in the United States) means a $100 million cash reserve loses nearly $9 million in purchasing power in one year of just sitting in cash. Even worse, CPI, the core indicator used for inflation, usually severely underestimates real inflation. Especially the costs of clinical trials have outpaced regular inflation significantly.

These two factors create a double vulnerability and have been a key driver of the ongoing market downturn or the “biotech winter” we are currently experiencing. In this environment, where raising new money is hard, treasury management becomes an essential - but often overlooked - strategic consideration.

The prevailing approach in Biotech, especially in times of “cheap” money, has often been to park large cash reserves in near-zero-yield accounts, exposing them to erosion over time. Biotech companies have historically accepted this because preserving capital was more important than earning a return on their cash balance. However, in the current market environment, the shortcomings of a cash-only treasury as outlined above have become more glaring.

For me, this context sets the stage for considering unconventional treasury moves – like adding Bitcoin to the treasury – to address the twin threats of inflation and low-yielding reserves, and in general to optimize and maximize shareholder value.

The Nature of Bitcoin

Bitcoin’s path to becoming digital gold

In the mainstream media, Bitcoin has mostly captured widespread attention for its volatility profile and ability to make outsized gains. This, while true of any nascent asset, often overlooks the clearer image that is being presented when Bitcoin is being put on display: storing value is paramount in the coming decades of high inflation and more rate sensitive markets.

Bitcoin presents a unique profile as defined below:

1. A finite supply of 21 million BTC, ensuring scarcity and protecting against inflation and currency debasement.

2. A decentralized structure, immune to government intervention and monetary mismanagement from politicians.

3. An immutable ledger, that provides transparency and security in an era of increasing financial distrust.

These characteristics position Bitcoin, in my opinion, to become the best long-term store of value over time - in short: DIGITAL GOLD.

Both assets – Bitcoin and Gold - derive their value from scarcity - gold through its finite natural supply and Bitcoin through its hard cap of 21 million coins. However, Bitcoin has unique advantages due to its digital nature, allowing for seamless cross-border transactions, greater divisibility, and much easier storage compared to its golden counterpart. Bitcoin is still in a price discovery phase, but as institutional adoption increases and liquidity deepens, I believe Bitcoin will exhibit price stability and an increase in purchasing power parity more akin to gold.

If Bitcoin achieves even partial parity with gold in the global store-of-value market, there is massive upside potential - gold’s total market capitalization is still approximately 13X higher than Bitcoin’s.

Increasing Macroeconomic Uncertainty

If you would like an easy formula behind why I believe Bitcoin’s long-term price trajectory will continue to rise, consider this: over a long enough period of time, Bitcoin’s price is directly correlated to government mismanagement, excessive monetary expansion, and geopolitical instability - forces that erode confidence in traditional fiat currencies over time.

It occurs to me that if there’s one constant in life, it’s that there will always be some degree of political mismanagement. For example, just look at the excessive government spending during the COVID-19 pandemic, various hyperinflations in developing countries, and the new German Chancellor’s recent abandonment of all prudent fiscal policies in embarking on a nationwide spending spree.

Political Acceptance

One of the biggest hold backs for the price of Bitcoin and its corporate adoption was the anti-crypto posture of the previous US administration(s), as well as of many other governments around the world. And despite these unjustified, backward-looking policies, Bitcoin soared. This makes me even more optimistic for what Bitcoin can achieve in the future, unburdened by what has been.

I also view President Trump’s recent executive order creating a Strategic Bitcoin Reserve (SBR)[1] for the United States as pushing this concept further into the mainstream. As more nations, corporations, and institutional investors recognize Bitcoin’s long-term role as a monetary hedge, it stands to reason that demand will only increase, driving price appreciation relative to USD, as well as compared to traditional stores of value like gold.

"This moment is about more than just financial strategy - it's about American identity. What binds us as a nation? Not race, religion, or a shared ancestry, but a creed - a belief in individual liberty and the right to pursue success without bureaucratic interference. Bitcoin embodies that same ethos: sovereignty, self-reliance, and an unbreakable financial system." Vivek Ramaswamy

Financial Inclusion

Sometimes, people in the West forget there are other huge parts of the world, particularly amongst the poorest populations, where financial infrastructure is either inaccessible or prohibitively expensive. While a German or American citizen might dismiss the idea of needing an independent store of value or an “escape currency”, a person from Venezuela, Ukraine or Zimbabwe might give a very different answer.

Hence, Bitcoin is not just a store of value and digital gold - to me, it is the foundation of a more inclusive financial ecosystem and financial freedom for everyone. Bitcoin is truly decentralized and actively used by an estimated 500 million people around the world today. It provides individuals and businesses with an alternative to fragile local currencies, capital controls, and banking restrictions. This is all secured by the strongest computing network in the world - making it in totality, arguably one of the single greatest technological accomplishments in human history.

Bitcoin as Treasury Asset

All of Bitcoin’s properties and its potential, as outlined above, make it a necessary part of any treasury strategy, especially for biotech companies who are disproportionately at risk of inflation-impacting cash reserves. I expect more and more companies to include Bitcoin in their treasury strategies, as pioneered on a large scale by Michael Saylor’s Strategy (MSTR), with an interesting corollary being that this adoption cycle alone has the potential to drive Bitcoin prices.

For an in-depth introduction to the history and viability of Bitcoin as part of a treasury strategy, please check out this research from Fidelity. I couldn’t have compiled it better myself.

Especially for biotech, an active treasury management should also encourage more analytical rigor around cash spend since there is performance hurdle that needs to be cleared to justify spending. Large companies usually have a standard governor in place - spend money to grow or buyback stock. In biotech it’s almost always “spend” because there is no active benchmark on an alternative return for treasury. While most biotech companies will almost always conclude that spending dollars on R&D vs an active comparator is the right idea, having an actually active comparator can raise the hurdle rate they have to underwrite against to justify spending $’s on a new project.

atai’s Treasury Strategy Going Forward

Runway into 2027

atai’s primary financial objective coming into 2025 was to secure sufficient funding to carry the company into 2027, enabling the execution of its pipeline and anticipated publicly stated clinical readouts over that period, without liquidity concerns. With its most recent capital raise of $63.25M in gross proceeds, atai has already successfully met this goal[2].

I also participated in this last capital raise, taking the opportunity to increase my stake significantly.

Embracing Bitcoin

atai has been thinking proactively about how to best manage this recent increase in capital and per an 8-K filed today has decided to include Bitcoin as part of its treasury, primarily as a long-term inflationary hedge, and secondarily as a short-term form of diversification with appreciation potential that traditional treasury assets can’t provide.

While there are certain companies out there whose Bitcoin treasury has become so large that it practically became the business model of the company, I want to point out that atai is and always will be a biotech company. The company’s core mission is the advancement of novel mental health therapies, especially psychedelics, addressing a significant unmet medical need.

For atai, Bitcoin is an innovative financial tool which I believe will help the company to fulfill its mission even better: bringing solutions to patients in need and creating value for its shareholders.

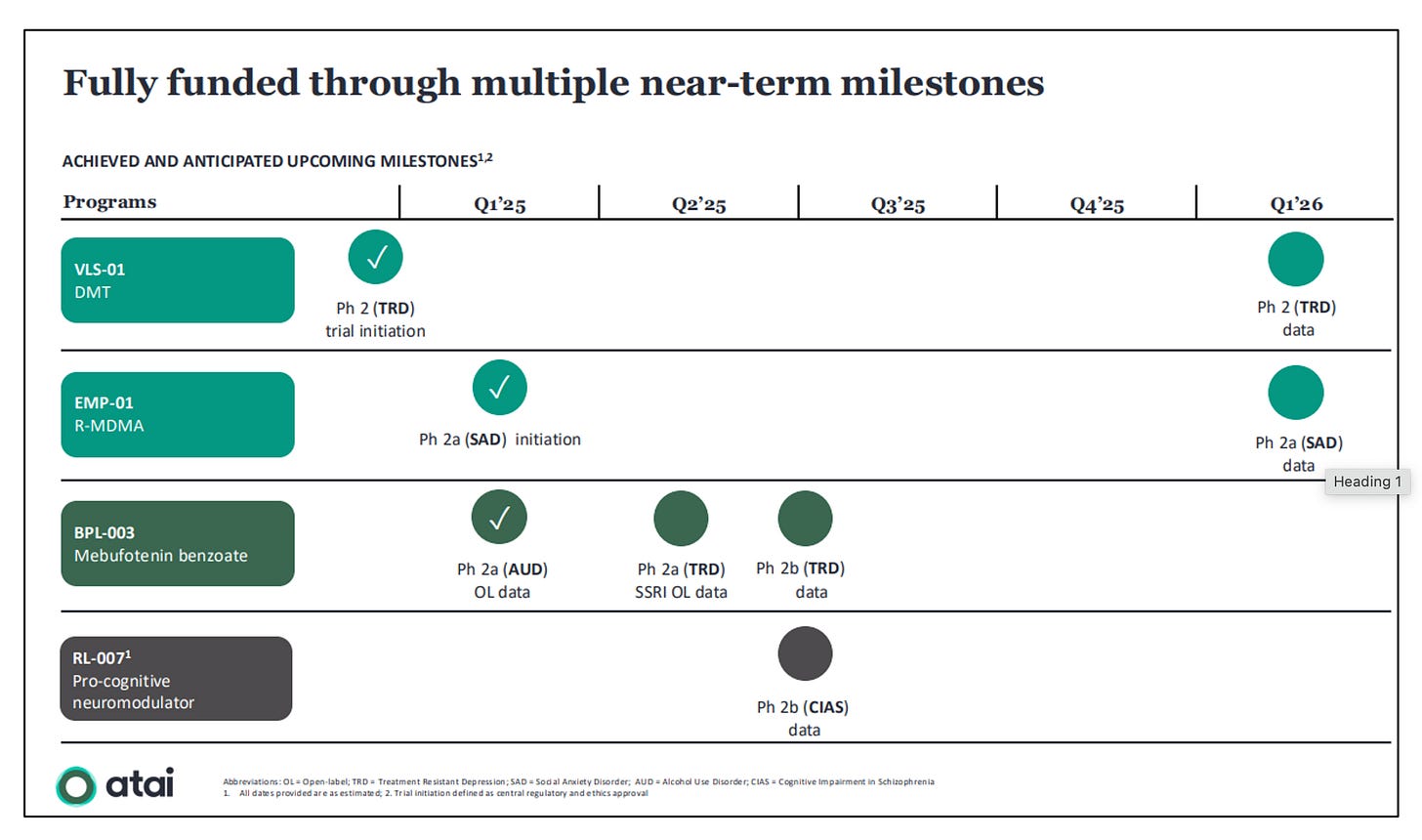

Over the next 12 months, atai anticipates FOUR Phase 2 readouts, each of which has the potential to be a meaningful event for the company and all of its stakeholders. In a positive readout scenario, any one of these milestones could significantly enhance atai’s valuation and financing opportunities.

While Bitcoin as a long-term store of value is not in doubt for me, we must also acknowledge that Bitcoin can, and likely will, have short term price fluctuations. Therefore, atai has taken the prudent decision to hold sufficient cash (mostly USD), short-term securities, and public equity holdings for its desired run rate into 2027, atai will invest an initial position of $5M in Bitcoin which is not anticipated to impact drug development timelines or current operational runway.

Please visit www.atai.com to learn more about atai and its pipeline, and please don’t forget to sign up for atai’s investor relations newsletter, to be updated regularly about its operational progress as well as the progress of its Bitcoin treasury strategy.

And stay tuned for part 2: While this blog post focuses on the hard facts about why I believe Bitcoin is a valuable part of atai’s (and any company ’s) treasury strategy, in my next one coming out in a few days I will focus more on the philosophical alignment between Bitcoin and psychedelics.

Sign up for my Substack to not miss it.

[1] https://www.whitehouse.gov/fact-sheets/2025/03/fact-sheet-president-donald-j-trump-establishes-the-strategic-bitcoin-reserve-and-u-s-digital-asset-stockpile/

[2] https://ir.atai.life/news-releases/news-release-details/atai-life-sciences-announces-closing-public-offering-and-full

Huge kudos for paving the way as the first (public) psychedelic company to adopt a BTC treasury! I recently came to the similar conclusion that it will be imperative for ALL psychedelic companies to do so not only to hedge against inflation, but also extend its runway amidst regulatory hurdles with unknown timelines and to not cut corners as psychedelics gets commercially integrated into above-ground mainstream.

P.S. recently finished creating a level 1 presentation titled "Bitcoin: The Ultimate Ego Test (A Psychedelic Journey Through the Matrix of Money) and currently in the beginning stages of creating a level 2 presentation titled "The Sacred Parallels of Psychedelics x Bitcoin (Freedom Within, Freedom Without). Looking forward to your part 2!