Feeding the AI Boom: Why Apeiron is Betting Big on Copper

Last month, we unveiled Apeiron Investment Group’s new vertical, Natural Resources (Tech), with our investment in Uranium Digital, a venture modernizing how nuclear fuel is traded. Check out more about Uranium Digital here:

The main reason for adding this vertical is that we at Apeiron believe Generative AI – especially when paired with robotics – will structurally change the world as we know it.

AI will kick off an unimaginable economic boom, starting from basic infrastructure needs like data centers to a general broad industrial boom of “re-industrializing” the West. All those businesses crave for natural resources, especially those needed for energy (like uranium) and for data centers & chips (like silicon, germanium, phosphorus, boron, indium phosphide and copper).

Today, I’m excited to announce our second theme in this vertical: copper.

Specifically, our investment in Super Copper Corp., an emerging exploration platform positioned to capitalize on the structural copper shortage. Please find the official news here.

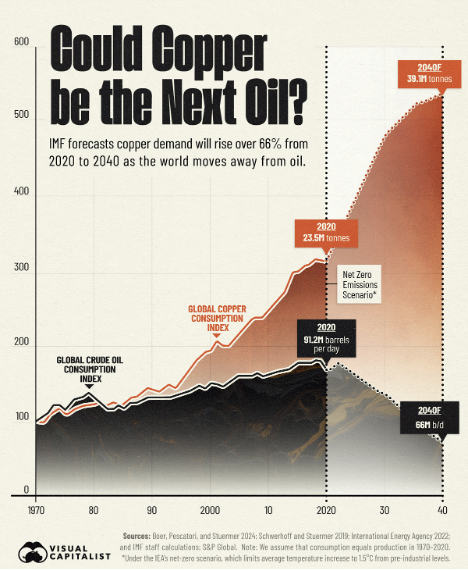

Copper is often called “the metal of electrification”, and for good reason. As the world races toward advanced infrastructure, demand for copper is set to surge while new supply struggles to keep up. This imbalance creates an asymmetric opportunity – a scenario of rising long-term demand against constrained supply. We believe this dynamic will drive copper prices and valuations of copper-related companies higher over the coming years, benefiting those who invest wisely today.

An Overview on Super Copper

Super Copper (CSE: CUPR | OTCQB: CUPPF | Frankfurt: N60) is an emerging mining exploration platform which capitalizes on this opportunity. Our conviction is rooted in market insight, strategic reasoning, and a long-term vision shared between the Founder Zachary Dolesky and us.

In this post, I want to articulate our investment thesis for copper and why we’re excited to be investors in this company.

Copper’s Strategic Role: Manufacturing, Infrastructure, and Defense

Copper is fundamental to industrial manufacturing, national defense, and critical infrastructure. About 45% of global copper consumption goes directly into building construction, while electronics and manufacturing equipment consume roughly 22% (U.S. Geological Survey, Mineral Commodity Summaries, January 2024). In modern manufacturing, copper is vital for machinery, robotics, and automated factories, with global electric motors alone consuming over two million tonnes annually (Copper Development Association).

The metal is also strategically significant in defense and national security. Copper ranks second only to steel in defense manufacturing usage in the United States, crucial for munitions, military vehicles, and advanced electronic systems. Recent global conflicts underline copper's strategic importance—artillery expenditures alone consume thousands of tonnes of copper. Recognizing this, governments are increasingly considering classifying copper as a critical mineral, essential to national security.

Further, infrastructure demands—particularly data centers, AI computing facilities, and electrical grid upgrades—are significantly driving copper use higher. A single AI-focused data center can contain tonnes of copper in power distribution, cooling, and networking infrastructure (IEA [3]). Rapid digital infrastructure expansion, combined with traditional infrastructure investments, is amplifying global copper demand.

A prime example is the recent $600 billion investment agreement between Saudi Arabia and the United States, which includes substantial commitments to AI data centers, energy infrastructure, and critical minerals, underscoring the magnitude of future copper consumption growth (White House, 2025).

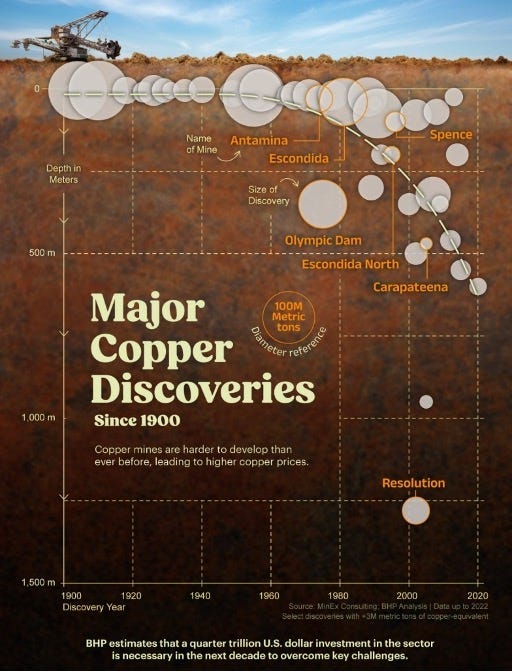

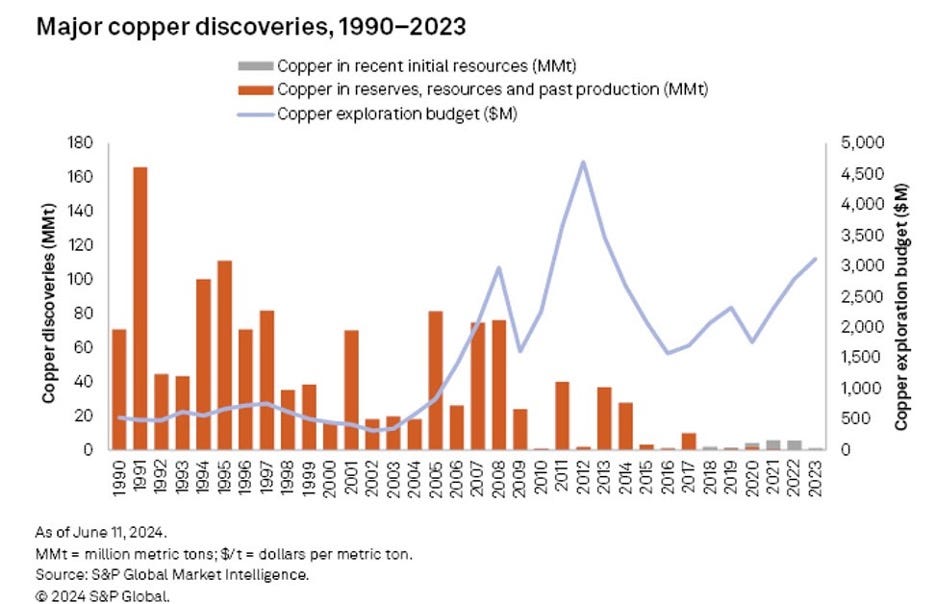

However, despite copper demand expected to nearly double from 25 million to 50 million tonnes by 2035 (S&P Global [5]), copper supply remains constrained by aging mines, declining ore grades, and prolonged project development timelines averaging 17 years (S&P Global [5]).

Industry experts forecast substantial copper deficits emerging by the late 2020s and early 2030s, potentially reaching several million tonnes annually (Bloomberg NEF).

With constrained new supply and structurally rising demand, copper offers investors a compelling asymmetric opportunity—now is the time to strategically position portfolios in anticipation of this tightening market.

The Asymmetric Investment Thesis

We believe the combination of increasing structural demand and constrained supply is creating an asymmetric investment opportunity. The upside scenarios (strong demand growth amid supply shortages) could push copper prices and asset values significantly higher, while the downside scenarios (e.g. a short-term economic slowdown) are buffered by the fact that supply is so fundamentally tight that prices likely have a floor. Here’s why we find the risk-reward so compelling:

High Conviction Demand Drivers: The electrification trend is not a speculative bet – it’s already underway and backed by trillions in planned spending globally. Every major automaker is developing EVs, governments are mandating clean energy, and consumers are increasingly buying electric and electronic products. These are decade-long drivers for copper demand that are unlikely to reverse. Even under conservative assumptions, copper usage in energy transition applications (EVs, renewables, etc.) will multiply. BHP expects the energy transition sector to grow from 7% of copper demand today to 23% by 2050 (mining.com), and similarly transportation (mainly EVs) is seen rising from 11% to 20% of copper demand by 2040 (mining.com). What this means is that a large portion of future copper demand is essentially “baked in” by policy and economic trends – giving us confidence that long-term demand will be robust almost regardless of short-term cycles.

Inelastic and Slow Supply Response: Normally, when a commodity price rises, producers rush to increase supply – but copper’s supply is extremely inelastic in the short-to-medium term. You cannot quickly build a new copper mine; the average lead time of 15–20 years (baresyndicate.com) means that the supply for the next decade is largely predetermined by decisions made years ago (when many companies were cutting back). Even existing mines can’t dramatically boost output without running into grade limits or technical bottlenecks. This gives copper an unusual resilience: even if prices rise, supply will lag, potentially keeping the market tighter for longer. Conversely, if the global economy hits a soft patch and copper prices dip, many high-cost mines would cut output or defer expansions, tightening the market again. Few commodities have this degree of structural support on the supply side.

Favorable Long-Term Pricing: We are already seeing evidence of this imbalance in pricing. Copper has been trading at historically high levels in recent years, and analysts expect deficits to emerge that could support elevated prices through the 2020s. Some forecasts call for copper to potentially revisit or exceed all-time highs in the next few years if project delays continue. Importantly, the cost of developing new mines (and the $2+ trillion needed in industry investment by 2050 (mining.com)) implies that prices need to stay high enough to incentivize that investment. In essence, the cost curve is rising – new copper is expensive to produce – which likely raises the long-term floor price for copper. For investors, this means that even the “base case” for copper is attractive, while the bull case (high demand and big deficits) is extremely attractive. It’s a classic asymmetric setup: the downside is protected by fundamental scarcity, and the upside could be a super-cycle.

In summary, we see copper exposure as an important component for any portfolio oriented toward the energy transition or future infrastructure.

How best to invest in this theme?

One can gain copper exposure in several ways – from buying physical copper or ETFs, to investing in large established mining companies, to backing early-stage exploration ventures.

We’ve chosen to focus on the exploration end of the spectrum with our investment in Super Copper Corp. because we believe that’s where the unique leverage and value creation potential lies.

Leveraging Early-Stage Exploration for Maximum Upside

Not all copper investments are created equal. In fact, the difference between investing in a giant copper producer and a small exploration company is as wide as the gap between a large pharma company and an early-stage biotech startup.

Like with our tech and biotech investments, our strategy is to invest in and build an early-stage copper exploration and development platform, because it can offer advantages that larger mining companies cannot match, particularly in terms of agility and upside potential.

Here are a few reasons why we believe the Super Copper platform provides unique leverage:

Valuation Upside: A major mining company might produce hundreds of thousands of tonnes of copper per year and earn billions in revenue – great for stability, but it means even a sizable new discovery only moves the needle modestly on their valuation. In contrast, a successful discovery by a junior explorer can create a step-change in its value – very similar to a biotech company successfully proving its drug in Phase2b. We are effectively targeting the “zero to one” stage of value creation – the moment a deposit is defined and de-risked. Large producers often end up acquiring such juniors at a premium, meaning investors in the junior space capture that value uplift. In short, owning a quality exploration company is like having a leveraged option on copper prices and discovery success. The upside is asymmetrically high, in line with the copper market fundamentals.

Capital Efficiency and Focus: Early-stage companies can be surprisingly capital-efficient in advancing projects. Rather than spending billions on buying producing mines (as a major might have to do to increase output), a lean explorer can invest a few million dollars into drilling and geophysics and potentially outline a brand-new copper resource. The cost of discovering a pound of copper in the ground via exploration can be much lower than the cost of acquiring that pound through M&A or developing a giant mine from scratch. Moreover, explorers like Super Copper are typically laser-focused on rapid progress of their flagship asset, without the distraction of managing multiple sprawling operations worldwide. In practice, that often translates to faster decision-making and agility – drill programs can be adjusted in real-time, new targets tested quickly, and partnerships formed expediently. In a commodity cycle upswing, being small and nimble is a big advantage; it allows the company to capitalize on windows of opportunity (like favorable drill seasons or financing windows).

Entrepreneurial Talent and Innovation: Many of the best exploration successes come from small teams that think outside the box – applying new geological models, deploying innovative exploration technology, or venturing into overlooked areas. Early-stage companies are often led by passionate geologists and entrepreneurs (in our case, Zachary Dolesky) who have deep expertise and a personal stake in the outcome. Their incentive is clear: make the big discovery or advance the project and create massive shareholder value. This alignment can drive a level of effort and creativity that outperforms what big corporate budgets achieve. Additionally, a smaller team can be more open to integrating the latest tech, whether it’s hyperspectral imaging, AI-driven target selection, or novel extraction techniques, which may increase the odds of success or lower the costs. Super Copper, for instance, has been leveraging modern exploration tools (like satellite imagery and new geophysical processes) to pinpoint new prospective drill targets. As investors, we are backing the Super Copper team because success, even if probabilistic, is transformative. Of course, not every exploration project will strike it big – there are risks, and that’s why careful selection is key. We mitigate risk by choosing companies with outstanding project potential in proven districts and forward-thinking leadership. When the right ingredients are in place, the explorer model offers a combination of small-capital input and potentially large-capital output.

M&A Potential: It’s worth noting that in a supply-constrained environment, the large mining companies can turn to acquisitions to fill their project pipeline. We are already seeing increased merger and acquisition activity in the copper space, as majors understand it can be more cost and time-effective to buy a promising deposit than to explore for one themselves. This reality provides an extra “exit” opportunity for quality exploration plays: a successful project can make the company a takeover target at a significant premium. While our intent with Super Copper is to build a lasting platform, we welcome the validation that interest from larger players would imply. Knowing that majors are on the hunt for new copper assets adds another layer to the asymmetric upside: not only could Super Copper appreciate through organic success, but it could also re-rate quickly if a strategic enters the picture. In essence, there is a prospect of multiple shots on goal – organic growth and potential buyouts – whereas majors focus on the increasing existing production results.

In summary, investing at the exploration stage provides maximum leverage to the copper thesis. It’s akin to venture capital in the mining sector, higher risk than buying a blue-chip miner, but with the potential for much higher reward. Our strategy is to mitigate the risks by selecting the right project and team. This brings us to Super Copper and why we’ve chosen it as the flagship for our copper investment platform.

Super Copper: Building a New Mining Exploration Platform

Super Copper Corp. is the exploration company we’ve backed to become a next-generation copper exploration platform. The company is focused on the Cordillera Cobre project in Chile, its flagship asset, and plans to expand into a broader copper platform across other mining-friendly jurisdictions globally, especially in Africa, where we can add a lot of value with our network.

We’d like to highlight what makes Super Copper so compelling:

Cordillera Cobre – Their Flagship Project in Chile: The Cordillera Cobre project is in the Atacama region of northern Chile, near the mining center of Copiapó. Chile is the world’s #1 copper-producing nation, and the Atacama region in particular hosts numerous giant copper deposits. Cordillera Cobre sits within the copper-rich Venado Formation in a district with world-class infrastructure and nearby global majors (https://www.supercopper.com). In other words, this project isn’t in the middle of nowhere – it’s in a proven belt where big mines have been built before, and roads, power, and port access are all within reach. That gives us confidence in the project’s development potential and reduces future hurdles. What’s truly exciting, however, is the geological potential Super Copper is uncovering. Early exploration results have been very promising: recent surface sampling returned multiple high-grade copper assays, including samples grading over 5% to 10% copper (news release dated February 18, 2025) – exceptionally high for early-stage field work. In total, dozens of samples exceeded 1% copper across multiple zones, indicating a widespread mineralized system at surface. These results suggest Cordillera Cobre could host a copper deposit (or deposits), possibly in the style of an Iron Oxide Copper Gold (IOCG) system or a high-grade skarn/porphyry system, both of which Chile is famous for (juniorminingnetwork.com).

The next steps – geophysical surveys and prospective drilling – aim to test the depth and continuity of this mineralization. The combination of a favorable location (prolific district, existing infrastructure) and encouraging early results makes Cordillera Cobre a flagship asset that can drive the company’s value in a major way if the drill bit proves out its potential.

Beyond Chile – A Global Vision: While Cordillera Cobre is the current focus, Super Copper intends to build a broader platform of copper projects over time. Our strategy is to target mining-friendly jurisdictions that offer the highest geological prospectivity. Chile is a natural first step given its copper dominance and established mining framework.

Looking ahead, the company is evaluating opportunities in other regions – for example, the United States, Africa, and more – where copper opportunities can be advanced with the right local partnerships and expertise. Especially in Africa and the US, we believe we can support the company with our deep local networks.

The end goal is to create a portfolio of high-quality copper assets that provide diversification across geography and project stage. By assembling a pipeline (from exploration through development), Super Copper can smooth out risk and position itself as a supplier of choice for the copper that the world so desperately needs. We are essentially aiming to incubate the next copper exploration platform: one that grows through discovery and smart acquisitions, rather than inheriting legacy issues of aging mines. This ambitious plan is only feasible with the right backing and team, and we believe we can be a value-add strategic shareholder.

We enable Super Copper to differentiate itself. It is not a typical junior miner scratching for funding. Our backing and substantial capital commitment should help drive the exploration and growth plans. We see Super Copper as a long-term platform, not a short-term trade. This level of support should give Super Copper a huge advantage: the ability to execute exploration programs at speed, attract top talent, and seize new opportunities (such as acquiring additional projects) without constantly worrying about where the next financing will come from.

The Entrepreneur

Like in our other divisions, everything is centred around the entrepreneur. Zachary Dolesky is leading the charge as the Founder and CEO of Super Copper. He brings a blend of technical know-how and strategic vision, having both a background in operations from early stage to exit. The team also includes seasoned geologists and advisors in North America who have worked on world-class discoveries.

In short, Zac now has the capital, the team, and the vision to build Super Copper into something extraordinary. He is actively de-risking the project through methodical exploration, while remaining entrepreneurial in seeking the next growth leap. His personal strong commitment is documented through a voluntary share lock-up he has signed for his entire position of 5,317,360 common shares.

Conclusion: A Vision for Copper’s Future

Our investment in Super Copper is about more than just one project or one company – it’s about positioning for the future we see coming. Copper is going to be a cornerstone of the global economy’s shift to sustainability and high-tech infrastructure. The world’s push to build clean energy systems and expand connectivity will hinge on a metal that is often taken for granted but is irreplaceable: copper. Yet, the path to supplying all that copper is uncertain and challenging. This mismatch between demand and supply is what creates a rare opening for visionary investors and companies.

References

U.S. Geological Survey, Mineral Commodity Summaries, January 2024 – https://www.usgs.gov/publications/mineral-commodity-summaries-2024

Copper Development Association (CDA) – https://www.copper.org

International Energy Agency (IEA), The Role of Critical Minerals in Clean Energy Transitions, May 2021 – https://iea.blob.core.windows.net/assets/24d5dfbb-a77a-4647-abcc-667867207f74/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf

The White House, Fact Sheet: President Donald J. Trump Secures Historic $600 Billion Investment Commitment in Saudi Arabia, May 2025 – https://www.whitehouse.gov/fact-sheets/2025/05/fact-sheet-president-donald-j-trump-secures-historic-600-billion-investment-commitment-in-saudi-arabia/

S&P Global, The Future of Copper: Will the looming supply gap short‑circuit the energy transition? – https://cdn.ihsmarkit.com/www/pdf/0722/The-Future-of-Copper_Full-Report_14July2022.pdf

Mining.com, “Copper industry needs to invest $2.1 trillion over the next 25 years to meet demand” – https://www.mining.com/copper-industry-needs-to-invest-2-1-trillion-over-the-next-25-years-to-meet-demand/

Bare Syndicate, Why Copper Prices Are Surging in 2025: EV and Green Energy Demand – https://baresyndicate.com/copper-prices-ev-green-energy/

Junior Mining Network, Super Copper CEO Featured on Pinnacle Digest and Announces Private Placement – https://www.juniorminingnetwork.com/junior-miner-news/press-releases/3375-cse/cupr/171514-super-copper-ceo-featured-on-pinnacle-digest-and-announces-private-placement.html

Super Copper Corp. official website –

https://www.supercopper.com

International Copper Association, Copper: The Material of Choice for Vehicle Manufacturers – https://internationalcopper.org/resource/copper-the-material-of-choice-for-vehicle-manufacturers/

BHP Insights: How Copper Will Shape Our Future – https://www.bhp.com/news/bhp-insights/2024/09/how-copper-will-shape-our-future

Disclaimer:

Personal Capacity

This post is published by Christian Angermayer in his personal capacity. All views expressed are his own and do not represent the views of Super Copper Corp. (“Super Copper”) or any of its directors, officers or employees. Super Copper had no editorial control over the content.

No Offer, Solicitation or Advice

The information contained herein is provided for informational purposes only and does not constitute (i) an offer to sell or a solicitation of an offer to buy any security, (ii) investment, legal, tax or accounting advice, or (iii) a recommendation regarding any security or investment strategy. Readers should consult their own professional advisers before making any investment decision.

Forward-Looking Statements

This post contains forward-looking statements within the meaning of applicable securities laws, including, but not limited to, statements regarding copper-market fundamentals, Super Copper’s exploration plans, potential resource size, future financings, and expected corporate milestones. Forward-looking statements are based on current expectations and involve numerous assumptions, risks and uncertainties that could cause actual results to differ materially. No assurance can be given that such statements will prove to be accurate, and Christian Angermayer undertakes no obligation to update any forward-looking statements except as required by law.

Conflict of Interest & Compensation

Christian Angermayer, through Apeiron Investment Group Ltd. (“Apeiron”), is a shareholder of Super Copper. Following a private-placement financing completed on May 30, 2025, Apeiron and its affiliates hold approximately 11% of Super Copper’s issued and outstanding common shares along with certain warrants and restricted share units. Consequently, Mr. Angermayer stands to benefit from any appreciation in the price of Super Copper securities mentioned in this post.

Third-Party Information

Market statistics, commodity-price data, technical information and industry commentary cited in this post have been obtained from sources believed to be reliable. However, neither Christian Angermayer nor Apeiron has independently verified such information, and no representation or warranty—express or implied—is made as to its accuracy, completeness or timeliness.

No Warranty; Limitation of Liability

All information is provided “as is” without warranty of any kind. To the maximum extent permitted by law, Christian Angermayer, Apeiron and their respective affiliates disclaim all liability for any loss or damage arising from the use of, or reliance on, the information contained in this post.

Jurisdictional Restrictions

The securities of Super Copper have not been registered under the U.S. Securities Act of 1933, as amended, or the securities laws of any other jurisdiction. They may not be offered or sold in the United States or to U.S. Persons absent registration or an exemption therefrom. This post is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation.

Past Performance

Past performance is not indicative of future results. Commodity prices and share prices can be volatile, and investors may lose all or a portion of their investment.

By reading or accessing this post, you acknowledge and agree to be bound by the foregoing limitations and restrictions.